FEDNOW IS ON SINCE JULY 2023

Recently the US Federal Reserve officially launched the US instant payment service FedNow following years of preparation. The service will facilitate everyday payments for individuals and companies, making money flow faster and more convenient. The initiative provides the Federal Reserve with more visibility on funds circulation among companies and people.

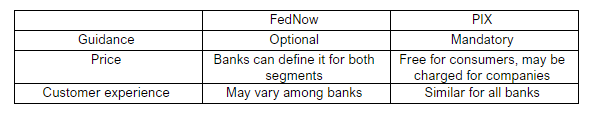

Despite the similarities with PIX in Brazil (instant payment transaction, 24×7 availability), FedNow and the US market have characteristics that may influence the adoption speed seen in Brazil (150m users after 30 months since it was launched).

A) Service is not mandatory, and the service guidelines are imposed by the Federal Reserve:

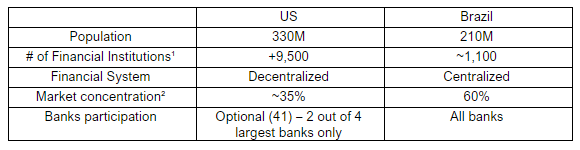

B) The US banking market is less concentrated and centralized (from the regulatory point of view) than Brazil.

Not all banks must be members of the Federal Reserve System (state banks for example). Also, there are over 4,500 credit unions under supervision of the National Credit Union Administration (NCUA).

As of 23rd August, there were 41 financial institutions¹ (banks and credit unions) participating in FedNow. This number is still low, considering that there are a total of 9,500 institutions.

FINANCIAL INSTITUTIONS WILL DRIVE THE FEDNOW JOURNEY OF SUCCESS

The Brazilian Central Bank reported recently (July 2023) over 150 million users of PIX (92% consumers and 8% companies), an impressive mark since it’s launched in 2020. This represents ~65% of the population in the 30 months since the launch. Today, all the benefits that PIX brought to the Brazil Financial System are well known.

In US, to accelerate the FedNow usage, Financial Institutions should have in mind:

1) Empowering clients with FedNow services may strengthen their value proposition, positively impacting customer engagement and banking preferences. Thus, time-to-market is key.

2) They were granted the autonomy of defining the customer’s journey and experience and this is an opportunity to differentiate their service and delight the customers.

3) FedNow may be only the first step of a set of transformation initiatives to come (digital currency for example). The transformation journey should take it into account.

In summary, it is expected that FedNow could contribute directly or indirectly to Banks by:

– Increasing customer engagement, retention, satisfaction and ultimately acquisition.

– Reducing operational costs (payments processing, non-electronic payments methods).

– Increasing transaction security.

EMBARK ON YOUR FEDNOW JOURNEY

Embark with Compass UOL to accelerate your modernization efforts, drive innovation, and gain a competitive edge in the dynamic financial landscape. Our expert team specializes in legacy modernization, API integrations, microservices architecture, uncoupled systems, cloud transformation, data-driven analytics, and more. We offer tailored solutions to drive growth and achieve long-term success with FedNow opportunity. Unlock the transformative power of modern Payment Technology in the Financial Sector.