Financial Institutions initiated their digital transformation journeys years ago driven by consumer behavior change, competition, and enablement of new technologies. New players emerged in this environment, democratizing financial services, and providing more options of products and services with lower or no charges for the consumers. As a result: approximately 5 banking accounts by consumer in 2023 (2x > 2012) in Brazil.

Despite all the efforts made by institutions to close gaps in their digital value proposition during these years, banks in general are still being challenged to 1) Conquer customer´s preference and loyalty (become the primary relationship) and 2) Keeping costs under control (seek for operational efficiency).

But how to truly develop a competitive advantage?

We believe that winning players must thrive in a set of abilities, but all of them relate to standing out in Assertiveness:

1) Deeply understand who their customers are (and will become) based on a real behavior segmentation, truly delivering a one single 360-degree client vision, regardless of the product or service or banking department/silo.

2) Keep delivering products, services, and solutions faster with quality.

3) Innovate with effectiveness to transform an existing journey or business model, changing the logic between consumers and traditional banking products.

4) Serve the clients assertively, optimizing cost-to-serve and channel strategy while improving overall customer satisfaction.

BUT HOW TO DRIVE ASSERTIVENESS?

It is expected that by achieving assertiveness, Financial Institutions benefit in different aspects:

1) Increasing active customer base

2) Increasing number of products per consumer and consequently revenue per customer (ARPAC)

3) Lowering operating costs (cost to serve optimization)

But, how to drive Assertiveness?

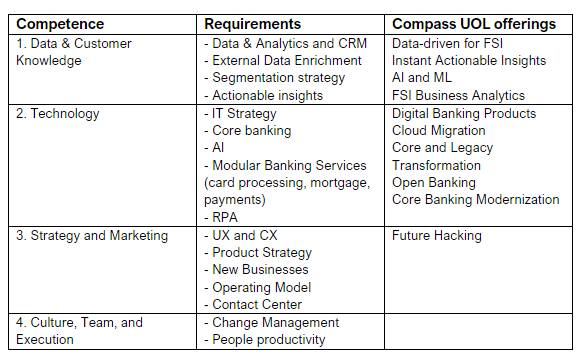

We selected and prioritized 4 key-competencies that organizations should pursue:

1) Data & Customer knowledge (and examples)

- Ability to identify and analyze credit cards transactions behavior and predict churn or share of wallet dispersion.

- Capture current account cash-in patterns changes (salary for a consumer or income for a commercial client) to proactively adjust credit thresholds.

- Improve assertiveness in the engine campaigns by transforming transactional data into valuable insights.

- In Mortgage, RPA applied to optimize unstructured data processing and evaluation, reducing the credit approval duration.

- Amplify personal equity evaluations by using non-structured data, identifying “under the water” assets and increasing credit assertiveness.

2) Technology (IT efficiency)

- Reduce legacy costs by modernizing core banking.

- Reduce IT infrastructure costs with cloud migration.

- AI applied to deliver software development faster and at lower costs.

- Reduce products and services time-to-market.

- Improve platforms availability and accuracy.

- IT and Data applied to execute better business functions (credit for example)

3) Strategy and Marketing

- Fit for Growth, adapting the existing operating model and organization structure for a new reality of the business, optimizing operating costs.

- Migrate clients to lower costs channels while improving customer satisfaction.

- Reduce communication costs and assertiveness.

- Prioritize strategic initiatives wisely and with higher ROE rates.

- Increase brand awareness.

4) Team, Culture and Execution

- Engaged teams with higher productivity rates.

- Lower turnover and higher satisfaction rates.

- Best people available in the market.

- Open environment to innovate.

The table below summarizes the key competencies: